In the fast-paced realm of the banking industry, consumer expectations are undergoing a profound transformation. As digital technologies continue to redefine the landscape, customers increasingly demand personalized, seamless, and technologically advanced banking experiences. From instant transactions to personalized financial advice, the modern consumer expects more than ever before. In response to these shifting expectations, Generative AI in the banking industry emerges as a key player in reshaping the customer experience. With its capacity to analyze vast datasets, generate personalized insights, and enhance user interactions, Generative AI is strategically positioned to align with and address the evolving needs of consumers in the dynamic and competitive banking sector. In this era of change, Generative AI stands at the forefront, offering innovative solutions to meet and exceed the heightened expectations of today’s banking customers.

Navigating The Tide Of Consumer Expectations

Consumer expectations and behaviour in the banking industry have undergone significant transformations in recent years, driven by technological advancements, changes in societal norms, and an evolving competitive landscape. Understanding these shifts is crucial for banks to stay relevant and meet the ever-changing demands of their customers. Here are key factors shaping consumer expectations and behaviour in the banking industry:

1. Digital Transformation:

Consumers now expect seamless, user-friendly digital experiences. They want to perform transactions, access account information, and manage their finances conveniently from their devices. There is a growing preference for online and mobile banking, with customers opting for banks that provide robust digital platforms. Mobile apps, online account management, and digital wallets are now integral to the banking experience.

2. Personalization:

Consumers anticipate personalized services tailored to their specific needs and preferences. They expect banks to know them and offer relevant products and solutions. Banks leveraging data analytics and AI to provide personalized recommendations, targeted offers, and customized financial advice are more likely to attract and retain customers.

3. Instant and Seamless Transactions:

The modern consumer expects real-time transactions and quick access to funds. The days of waiting for days for a transaction to clear are becoming obsolete. Immediate fund transfers, instant payment confirmations, and quick loan approvals are becoming the norm. Banks offering faster and more efficient transaction processes gain a competitive edge.

4. Social Responsibility:

Consumers want banks to be socially responsible and environmentally conscious. Ethical practices and a commitment to social causes are becoming essential considerations. Banks engaging in sustainable practices, supporting community initiatives, and showcasing corporate social responsibility initiatives are likely to resonate more with socially conscious consumers.

5. Convenience and Accessibility:

Consumers value convenience and accessibility. They expect banks to have a widespread network of ATMs, branches, and customer support options. Online and mobile banking have become the go-to channels for routine transactions. Banks with well-distributed physical presence and robust customer support options, including chatbots and virtual avatars, are preferred.

6. Education and Financial Literacy:

Consumers appreciate banks that invest in financial education and literacy initiatives. They expect guidance on managing finances and understanding complex financial products. Banks providing educational resources, easy-to-understand financial tools, and proactive communication on financial matters build stronger relationships with customers.

Challenges Arising From Shifting Customer Demands

1. Balancing Innovation with Risk Management:

Innovations such as open banking and new financial products introduce new risks. Banks must find a balance between fostering innovation and managing risks to maintain financial stability and customer trust.

2. Customer Education:

Educating customers about new technologies, products, and services is crucial. Some customers may be resistant to adopting digital channels or may lack awareness of the benefits of certain innovations.

3. Interoperability Issues:

Collaboration between traditional banks, fintech companies, and other third-party providers is essential for open banking initiatives. However, interoperability challenges and the need for standardized APIs can hinder seamless integration.

4. Cybersecurity Threats:

As banks embrace digital channels, they become more susceptible to cybersecurity threats. Cyberattacks, fraud, and data breaches pose constant challenges, necessitating continuous investment in cybersecurity measures.

5. Meeting Diverse Customer Expectations:

Catering to a diverse customer base with varying preferences and expectations can be challenging. Creating a personalized experience that resonates with different demographics requires a strategic approach.

6. Global Economic Uncertainty:

Banks must navigate through economic uncertainties, geopolitical events, and global market fluctuations. These external factors can impact the financial well-being of both the banks and their customers.

7. Rapid Technological Advances:

The rapid pace of technological change requires banks to stay agile. Keeping up with new innovations and ensuring that their systems remain compatible and competitive can be challenging.

8. Competitive Landscape:

Fierce competition from fintech startups and tech giants entering the financial space puts pressure on traditional banks to innovate continuously. Staying competitive requires a proactive approach to technology adoption.

Generative AI In The Banking Industry – The Strategic Enabler

Generative AI in the banking industry emerges as a transformative force, providing innovative solutions to address the myriad challenges posed by evolving consumer expectations. By leveraging the capabilities of generative AI, banks can effectively tackle these challenges, align with consumer behaviour, and enhance customer retention.

Here’s how generative AI acts as a strategic enabler:

- Utilizing advanced algorithms, generative AI analyzes vast datasets to understand individual customer preferences and behaviour. By generating personalized recommendations, targeted marketing campaigns, and customized communication, banks can create deeper connections with customers, fostering a sense of loyalty and satisfaction.

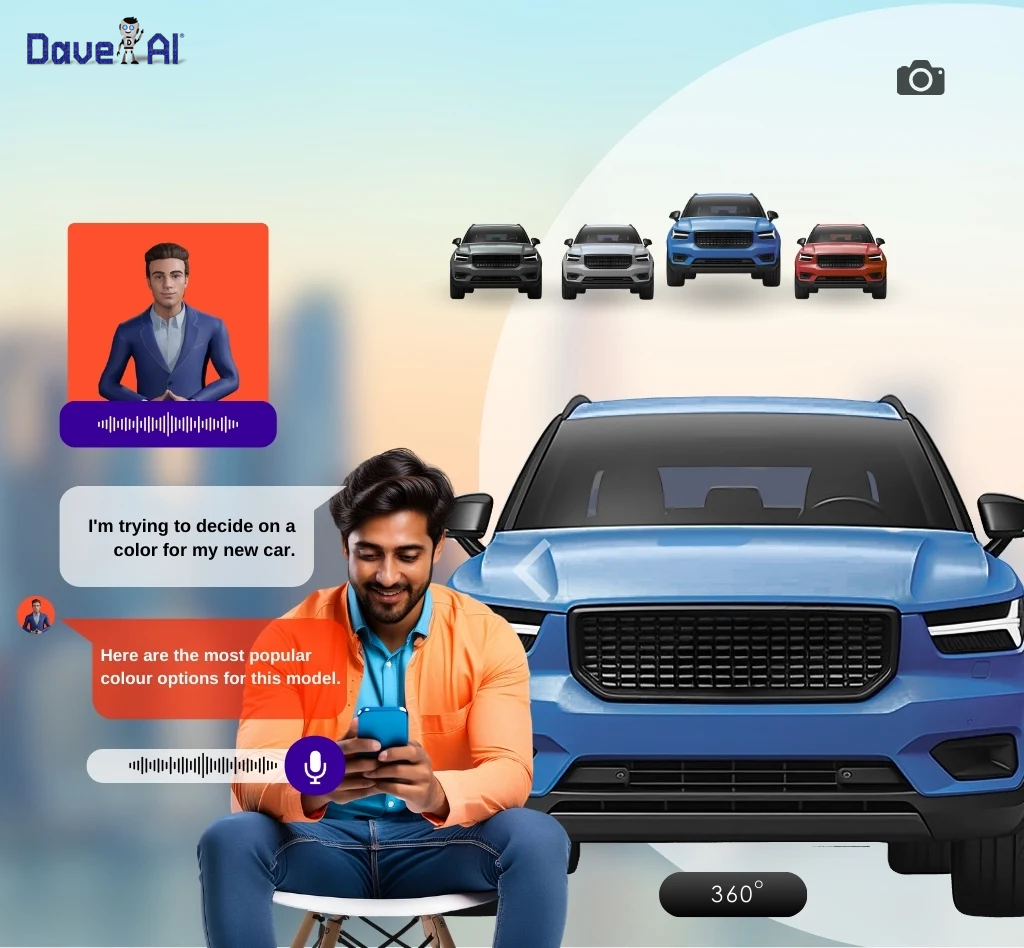

- Generative AI powers virtual assistants and chatbots, providing customers with instant, intelligent support in the digital realm. These AI-driven interfaces streamline digital interactions, guide users through online processes, and enhance the overall digital banking experience, contributing to customer retention in the era of digital transformation.

- By incorporating generative AI in fraud detection systems, banks can bolster security measures. The AI’s ability to analyze patterns in real-time enables early identification of potential fraudulent activities, assuring customers of the bank’s commitment to safeguarding their financial information and reinforcing trust.

- Automation powered by generative AI optimizes transaction processes, reducing latency and improving efficiency. This ensures customers experience faster, smoother transactions, meeting the demand for instant and seamless financial interactions.

- Generative AI facilitates interoperability by enabling seamless integration of diverse banking systems and third-party services. This capability ensures that banks can participate effectively in the open banking ecosystem, offering customers access to a broader range of financial products and services through collaborative efforts.

- Generative AI analyzes social trends and sentiment, enabling banks to align their messaging and campaigns with societal expectations. By crafting communication that reflects social responsibility, banks can resonate with consumers who prioritize ethical practices, contributing to a positive brand image and customer loyalty.

- AI-powered chatbots and virtual assistants enhance customer support accessibility. By providing instant responses, guidance, and support 24/7, generative AI contributes to overall convenience, ensuring that customers can access assistance whenever and wherever they need it.

- Generative AI assists in creating personalized educational content based on individual customer profiles. By generating targeted tips, explanations, and educational resources, banks can empower customers with the knowledge needed for effective financial management, fostering financial literacy and enhancing the customer relationship.

Banking Industry Insights From All Age Brackets

Consumer expectations in the banking industry are shaped by various factors, including age demographics. Different age groups have distinct preferences, priorities, and comfort levels with technology. Here’s an overview of what each age group generally expects from the banking industry, and how Generative AI can cater to their specific needs:

1. Generation Z:

Expectations:

- Digital Natives: Having grown up in the digital age, Generation Z prefers digital interactions. They expect banks to provide seamless, intuitive, and mobile-friendly platforms for banking transactions.

- Instant Gratification: Generation Z values speed and efficiency. They expect quick and hassle-free services, including fast account access, instant payments, and rapid customer support.

Generative AI’s Role:

- Generative AI can enhance user interfaces, making mobile and online banking more user-friendly for Generation Z.

- Chatbots powered by Generative AI can provide instant responses to queries, aligning with the desire for quick and efficient services.

2. Millennials:

Expectations:

- Tech-Savvy and Convenience: Millennials value technology-driven solutions and expect banking services to be accessible through various digital channels. They seek convenient and user-friendly mobile banking experiences.

- Personalization: Millennials appreciate personalized services and recommendations based on their financial behaviour and preferences.

Generative AI’s Role:

- Generative AI can power personalized financial advice, product recommendations, and targeted marketing messages for Millennials.

- Automated financial planning services driven by Generative AI can cater to the need for personalized financial guidance.

3. Generation X:

Expectations:

- Balanced Approach: Generation X tends to value a balanced approach, appreciating both digital convenience and the security of traditional banking. They may prefer a mix of online and in-person services.

- Financial Planning: With many in this age group focused on long-term financial goals, they seek tools and services that assist in financial planning.

Generative AI’s Role:

- Generative AI can contribute to a balanced banking experience by enhancing both online and in-person services.

- AI-driven financial planning tools can provide tailored insights for Generation X customers planning for major life events, such as retirement or education expenses.

4. Baby Boomers:

Expectations:

- Security and Stability: Baby boomers often prioritize security and stability in their financial relationships. They may prefer traditional banking channels and prioritize face-to-face interactions.

- Simplicity: Many in this age group appreciate straightforward and easy-to-understand banking services.

Generative AI’s Role:

- Generative AI can contribute to security measures, enhancing fraud detection and providing a robust defense against unauthorized access.

- AI-driven interfaces can be designed to be simple and user-friendly, catering to Baby Boomers who may prefer uncomplicated banking experiences. AI can also simplify and improve micro branch banking experiences.

Generative AI’s Universal Role Across Demographics:

Generative AI, with its ability to personalize services, enhance security, and streamline banking processes, has a universal role across all age groups:

- Personalization: Generative AI can personalize interactions, offers, and recommendations for customers of all ages, aligning with the diverse preferences of each demographic.

- Security: By continuously analyzing patterns and detecting anomalies, Generative AI contributes to enhanced security, addressing the concerns of customers across generations.

- Accessibility: AI-driven interfaces, such as chatbots, can provide accessible and instant support, catering to the varying preferences for digital interactions across age groups.

Best Practices For Banks To Leverage Generative AI

Implementing Generative AI in the banking industry involves a strategic and thoughtful approach. To ensure the successful adoption of Generative AI for customer retention, banks should consider the following best practices:

1. Define Clear Objectives:

Clearly outline the objectives and goals you aim to achieve with Generative AI. Whether it’s enhancing personalization, improving customer service, or optimizing security measures, having a well-defined strategy will guide the implementation process.

2. Invest in Data Quality and Security:

Generative AI relies heavily on data. Ensure that your data is of high quality, accurate, and securely stored. Implement robust security measures to protect sensitive customer information, addressing concerns related to privacy and confidentiality.

3. Focus on Customer Education:

Proactively educate customers about the integration of Generative AI and how it benefits them. Transparency about the use of AI in personalization, security, and customer service fosters trust and minimizes resistance.

4. Start with Pilot Projects:

Begin with small-scale pilot projects to test the effectiveness of Generative AI in specific use cases. This allows for refinement and optimization before scaling up implementation across the entire organization.

5. Integrate with Existing Systems:

Integrate Generative AI seamlessly with existing banking systems and processes. This ensures a smooth transition and allows for the consolidation of data across various touchpoints, providing a unified view of customer interactions.

6. Continuous Monitoring and Improvement:

Implement mechanisms for continuous monitoring and evaluation of Generative AI performance. Regularly assess its impact on customer satisfaction, security, and operational efficiency. Use feedback and insights to make continuous improvements.

7. Address Ethical Considerations:

Develop ethical guidelines for the use of Generative AI. Consider potential biases in algorithms, and implement measures to mitigate them. Being transparent about ethical considerations demonstrates a commitment to responsible AI use.

8. Engage Customers in Co-Creation:

Involve customers in the co-creation process by seeking feedback on AI-driven features and services. This not only enhances the customer experience but also provides valuable insights for refining Generative AI applications.

9. Build Scalability and Flexibility:

Design Generative AI solutions with scalability in mind. As the volume of data and customer interactions grows, the AI system should be able to handle increased demands. Additionally, ensure flexibility to adapt to evolving customer expectations and technological advancements.

10. Measure ROI and Business Impact:

Establish key performance indicators (KPIs) to measure the return on investment and the overall business impact of Generative AI. This could include improvements in customer retention rates, increased cross-selling success, or enhanced operational efficiency.

11. Collaborate with Fintech Partners:

Consider collaborating with fintech partners specializing in AI technologies. Fintech partnerships can bring in specialized expertise and technologies, accelerating the implementation of Generative AI solutions.

12. Create a Seamless Customer Experience:

Ensure that Generative AI seamlessly integrates with existing banking systems and channels. The goal is to provide customers with a unified and cohesive experience across digital and physical touchpoints. nce.

13. Stay Agile and Adaptive:

Embrace an agile approach to AI implementation. Be prepared to adapt strategies and models based on evolving customer expectations, technological advancements, and changes in the competitive landscape.

14. User-Friendly Interfaces:

Prioritize user-friendly interfaces for AI-driven applications. Whether it’s a chatbot or a personalized recommendation system, ensure that customers find the AI-powered features intuitive and easy to use.

15. Human-AI Collaboration:

Encourage collaboration between AI systems and human employees. AI should augment human capabilities rather than replace them. Develop training programs for staff to understand and work alongside AI tools effectively.

16. Stay Informed on AI Developments:

Stay in tune with the latest developments in AI. The field is continually evolving, and staying informed ensures that banks can leverage new advancements to enhance their AI capabilities.

Download our latest whitepaper on generative AI to know more!

By adopting these best practices, banks can harness the potential of Generative AI to not only meet but exceed customer expectations, ultimately creating stronger customer relationships and retention in a competitive banking landscape. Generative AI in the banking industry has a versatile role to play. By leveraging Generative AI strategically, banks can create an inclusive and personalized banking experience. DaveAI revolutionizes the banking landscape by seamlessly integrating generative AI into every facet of the process, from designing innovative financial interfaces to developing personalized customer experiences. With a keen understanding of banking needs and preferences, DaveAI ensures a smooth journey, offering unwavering support and effortless API integrations for banks to harness the full potential of generative AI in transforming their operations and customer interactions.