Imagine that you are in the Metaverse and in a virtual bank branch. You can see the teller, who appears as an avatar and can interact with them just as you would in a physical bank branch. You can open an account, apply for a loan, or conduct other financial transactions, all from the comfort of your own home. You can explore a three-dimensional space, view your financial portfolio, and conduct transactions in a completely immersive environment. This is the Metaverse, a virtual world that is fast becoming a reality. But the Metaverse is more than just a place to conduct transactions. It is a vibrant, dynamic world that offers endless possibilities for creativity and innovation. Banks can leverage the Metaverse to create unique experiences for their customers, such as immersive financial education courses, investment simulations, and virtual reality customer support. As leaders in the banking industry, it is important to stay informed about the latest developments in the Metaverse and how they can impact banking. By embracing this technology, banks can stay ahead of the curve and provide their customers with innovative, engaging, and personalized financial services.

The future of banking is no longer confined to physical buildings and traditional transactions. Instead, it lies within the immersive world of the Metaverse. With the evolution of AI and the Metaverse, banks have a unique opportunity to reimagine their services and tap into a whole new world of financial opportunities.

The Next Frontier Of Internet Banking

The Metaverse has the potential to become the next frontier of Internet banking as it offers a unique platform for financial transactions and services. One of the key advantages of the Metaverse is its ability to facilitate seamless and secure transactions between users and provide instant real-time advice that is not just accurate but also empathetic. For example, if a user needs urgent recommendations and assurance on a loan query, the Metaverse will provide an empathetic experience to customers that eases the anxiety with a life-like advisor avatar and environment that an internet banking platform usually lacks. When it comes to dealing with money on digital forums, a lot of apprehension can be seen. But with more security, personalization, and emotional support, Metaverse can blur the lines between the physical and the digital world for banks to witness greater participation from clients. With the help of blockchain technology, users can make payments, transfer funds, and conduct other financial transactions in a transparent manner.

Why Should Banks Explore Opportunities In The Metaverse?

If you are a bank, a financial institution, or an insurance company, be ready to support a phygital business model and pay attention to the emerging competition. Banks can launch virtual bank branches and insurance companies can launch virtual brokerages. Banks should ensure the strategy incorporates a method to support cryptocurrencies and other digital currencies of the Metaverse that could be dealt with through the banks or Metaverse ATMs. In the coming years, virtual equities and digital artifacts will see cycles of boom and bust. This is a time when banks need to adapt to this experience while preserving the traditional models. Banks could leverage their expertise in fintech to provide a range of services apart from the regular activities within virtual worlds such as virtual currency exchange, loans for virtual property, and investment opportunities.

1. New customer base: The Metaverse is a rapidly growing market that presents an opportunity for banks and fintech companies to expand their customer base. As more people spend time in virtual worlds, banks and financial institutions can offer financial services to these users, such as virtual banking, investment advice, and insurance.

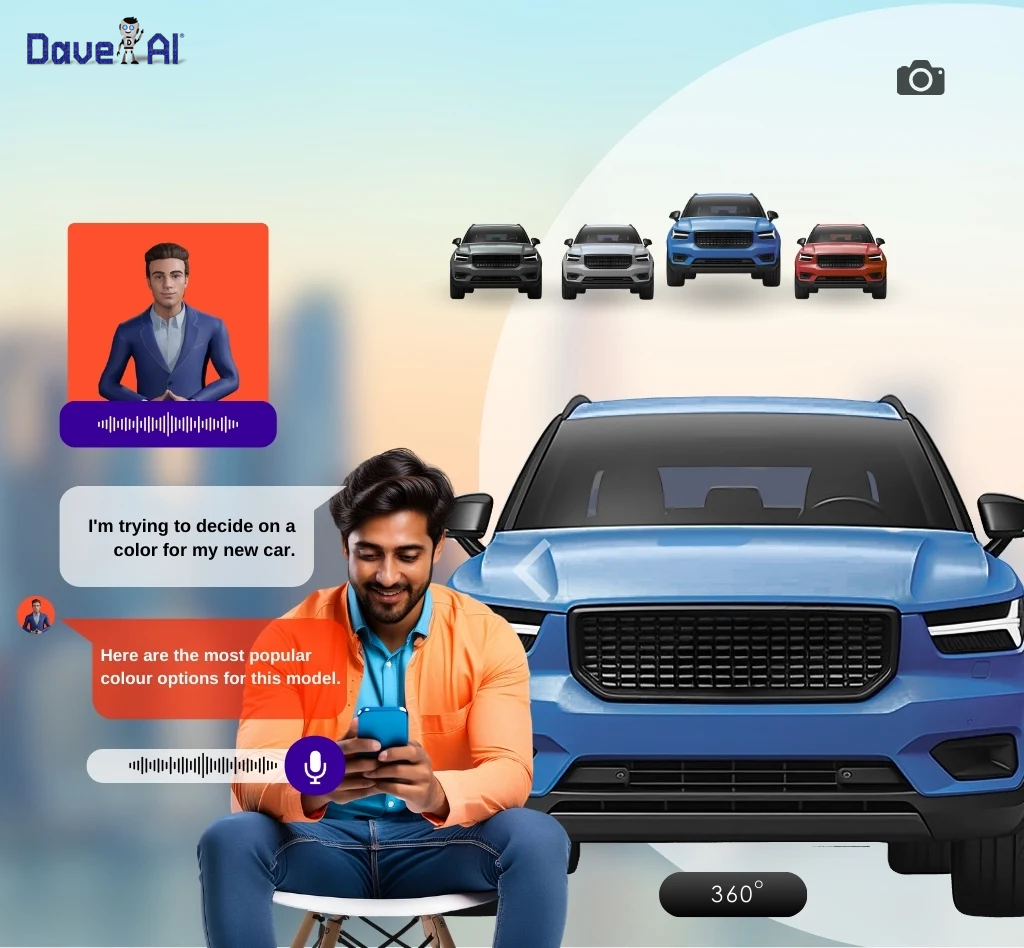

2. Improved customer experience: The Metaverse is a fully immersive experience where users can interact with each other and with virtual objects in a digital environment. Banks and financial institutions can use this technology to create more engaging and personalized customer experiences. Banks can create a branch in the Metaverse and allow all traditional activities to be carried out in this space along with added benefits of time, location freedom, community interactions, immersive environments, and instant real-time guidance through a virtual avatar that mimics a human brain.

3. New revenue streams: The Metaverse presents an opportunity for banks and financial institutions to develop new revenue streams. In the Metaverse, users will need virtual currencies to buy virtual goods and services. Banks and fintech companies can offer these virtual currencies and take a commission on transactions.

4. Innovative services: Apart from virtual currency exchange services, loans for virtual property, and investment opportunities, the Metaverse can provide banks with data on consumer behavior and preferences which can help product development strategies. Banks can offer virtual banking services within the Metaverse, such as virtual ATMs. By providing financial services within the Metaverse, banks can tap into a new market of consumers. For example, last year, HSBC partnered with The Sandbox to purchase land and interact with e-sports fans.

5. Marketing and branding opportunities: Banks can create virtual experiences that showcase their products and services to a tech-savvy audience. Banks can use Metaverse to create immersive experiences that allow customers to see and experience their products in a new way. By targeting consumers within the Metaverse, banks can reach a new audience that may be difficult to reach through traditional advertising channels. For instance, in 2021, Mastercard partnered with Decentraland to offer a virtual space where users could learn about Mastercard’s products and services.

6. Future-proofing: Investing in the Metaverse can future-proof banks against the changing technology landscape. As technology continues to evolve, the Metaverse will become an increasingly important platform for communication, commerce, and entertainment. By investing in the Metaverse now, banks can position themselves to take advantage of new opportunities as they arise.

7. Better risk management: Banks can use blockchain technology to provide a secure way of managing transactions and assets. This can help reduce the risk of fraud and cyberattacks.

8. Diversification of investment portfolio: By investing in the Metaverse, banks can diversify their investment portfolio beyond traditional assets such as stocks, bonds, and real estate. The Metaverse offers a new frontier of investment opportunities that can help banks increase returns. Non-fungible tokens (NFTs) are unique digital assets that can represent anything from art to music to virtual real estate. Banks can invest in NFTs or offer them as a service to their clients. In 2021, Citigroup announced plans to launch an NFT fund that would allow institutional investors to invest in NFTs.

9. Early mover advantage: By exploring Metaverse investment opportunities now, banks and financial institutions can establish themselves as early movers and gain a competitive advantage in this emerging market.

9

Case studies

The market size of the Metaverse is projected to reach $1.4 trillion by 2030. That’s a massive opportunity for banks to tap into a new and growing market. To demonstrate the potential profitability of investing in the Metaverse, let’s look at the growth of digital currencies. Bitcoin, the world’s first and most popular cryptocurrency, has seen a surge in value over the past few years. In 2017, Bitcoin’s value reached an all-time high of $20,000, and it has continued to appreciate in value since then. Many other digital currencies, such as Ethereum and Litecoin, have also seen significant growth in recent years.

JPMorgan entered the Metaverse domain last year. This bank has convened a lounge in the blockchain-powered environment for users known as the Onyx Lounge: report

1. Union Bank of India: One of the largest government-owned banks of India partnered with Tech Mahindra last year to create a banking environment in the Metaverse. The lounge they created was named as ‘Uni-verse’ and will allow customers access to all kinds of information like government welfare scheme details, loan rates, deposit rates, etc.

2. BBVA: A Spanish financial services company, has been actively investing in blockchain technology and the Metaverse. In 2018, the bank launched a blockchain platform for issuing and negotiating syndicated loans, and in 2019, it announced the launch of its first blockchain-based structured green bond. In 2021, BBVA announced a partnership with The Sandbox, a blockchain-based virtual world where players can create, share, and monetize their gaming experiences. The partnership involves the integration of BBVA’s payment services into The Sandbox’s platform, allowing players to use BBVA’s digital wallet to purchase and sell virtual assets within the game.

3. Societe Generale: A French multinational investment bank, has been experimenting with blockchain technology and the Metaverse since 2018. In 2019, the bank announced the launch of its first blockchain-based structured product, issued on the Ethereum blockchain. The product was available for trading on the OpenSea marketplace, a platform for buying and selling NFTs.

If the overall period graph is to be observed, starting from 2018, the adoption of Metaverse-related technologies in banking is constant with the only change being an increase in banks entering this domain. From hereon, the Metaverse will see more and more banks, financial institutions and customers enter from all over the globe.

Banking On This Strategy!

Banking in the Metaverse has come with a lot of benefits for financial institutions as well as customers. The need to prepare people for a shift is decreasing as the technology itself is making customers take a U-turn on the stance of rigidity. Facilities like digital assistants deployed to walk the space are helping user avatars find acceptance and see that yes, there is someone out there to help us and not just someone, someone like us! That perception of similarity has been found to draw an ace even in the game of life outside the virtual world. With Metaverse banks can provide advice in an emotive way that messages and emails simply do not, make immersive education experiences available for employees, and deploy safer wealth management and investment options for different assets. Attaching a third dimension to the process of regular banking and shaking hands with fintech, banks can heighten engagement and create trust that allows customers to be involved in a contract of partnership instead of being labeled as a consumer. With the world taking a token towards decentralized finance, it would really be interesting to see how things further unfold in the banking domain with a value-sharing experience at every ‘desk’ under the spotlight.