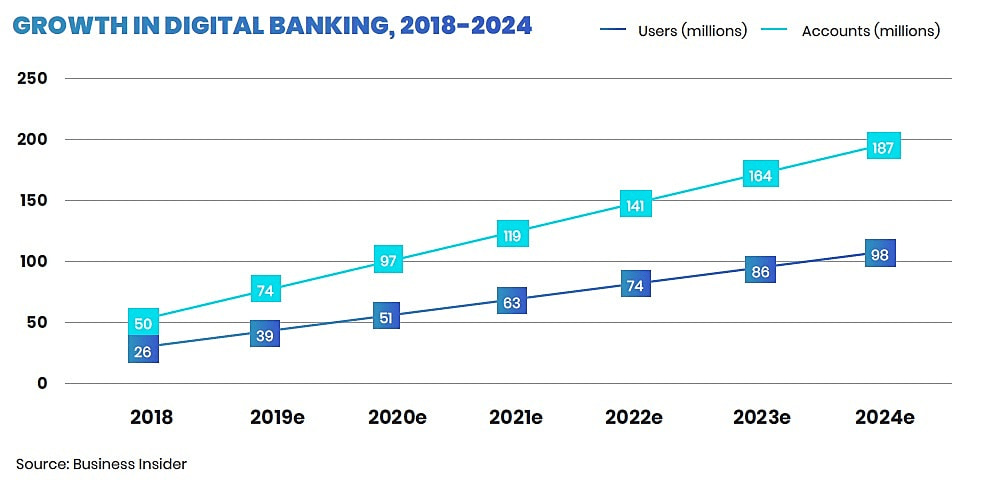

Digital-first banks have acquired eminence in India today and the financial inclusion reforms are ready to roar.

Take a look into the scenario of the banking ecosystem and its expeditious journey towards branchless banking in India through this article.

What is branchless banking?

Branchless banking in India has been outlined as the strategy that delivers banking services to people outside the traditional physical premises through kiosks, mobile phones, or other channels.

Clicks to supersede bricks

Banks across the country have often been seen grappling with various strategies to transform the current banking system in tune with the ever-evolving digital age. The pandemic led many physical banks to the realization that the digital customer experience was substandard. This has forced many financial institutions to revaluate their existing methodologies. The rapid advancement of AI today has given rise to the implementation of data-driven solutions that forms the foundation of digitalization in the banking sector.

Today digital transformation has three main elements under the scanner namely: enhancing performance, revamping the course of action, and rebuilding customer relationships. According to the Economic Times, the future of the banking domain has been seen as highly flexible with different digital solutions being adopted. With a focus on automated banking processes, profiling customers to satisfy regulatory demands and purveying bonus resources is going to be essential down the road. This can be achieved with the help of AI-based strategies, automation that personalizes the banking processes, and distributed ledger technology.

Micro branches paving the way

In the race to bid for the most profitable strategy, many banks are playing “keeping up with the Joneses” in the digital realm with other contenders. This slows down the process of innovation preventing everyone from making a difference. The first solid step required to be taken towards accelerating the process of digital-first banking involves implementing small-scale digital solutions at a time without trying to implement the concept of ‘all things online’ in one go. That is where the concept of micro branches comes into the spotlight and catalyzes a secure integration of physical banks into digital banking.

A peek into DaveAI’s vision for AI Micro Branches

Transitioning from a traditional bank towards the digital era is not easy. It requires a well-planned solution that can convert the bank branch into an experience center for the customers. This can be achieved using a next-gen digital solution known as the AI Micro Branch.

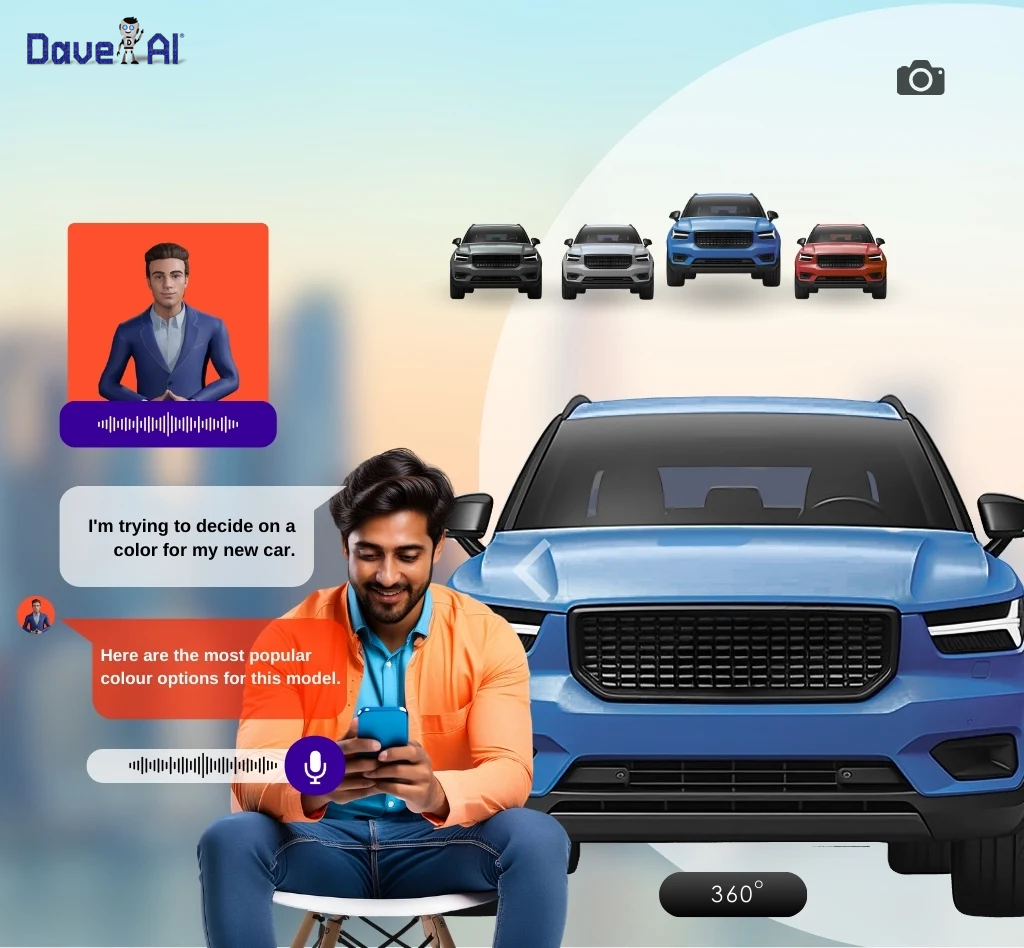

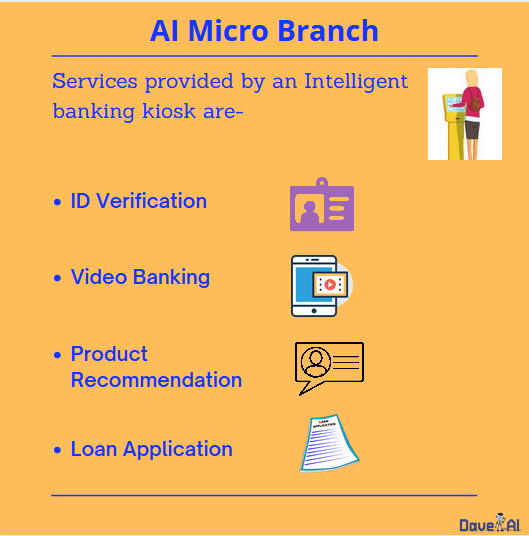

AI-based micro branches are developed to optimize the functioning of banking processes with a human touch. The features of these interactive kiosks are:

-Customer identification with the help of facial detection.

-Customer engagement through a virtual Avatar.

-Customer interaction with audio-visual content in natural language.

A platform capable of understanding user preferences and recognizing behavioral patterns makes real-time assistance to customer queries instantly possible that leads to an ideal digital financial experience.

The execution of this strategy leads to-

85% Increased customer engagement

35% Improved lead qualification

90% Reduced capital cost

A micro branch is one of the most trusted solutions to take a traditional bank towards branchless banking seamlessly. Integrating self-service in the form of AI chatbots or virtual avatars on different channels while providing banking services digitally to the customers keeps the essence of the physical banks alive in blend with the ease of the digital world to serve a well-versed customer experience.

“Setting up a local touchpoint is the easiest way for banks to reach out to their customers. However, there are limits to how many such touchpoints a bank can sustain. Artificial Intelligence is now helping branches to be available everywhere, whether in crowded malls and train stations or in remote areas. Now, anyone can learn more about the different banking products by asking our AI-powered Avatar questions and can apply for a loan, credit card, or insurance. The Avatar can clarify complexities and options available in the banking products, and personalize the banking journey at scale.”

– Dr. AnanthaKrishnan Gopal, Co-founder & CTO – DaveAI

You can also take a look into this use case to understand the implementation of the solution -> Branchless banking

Benefits of branchless banking in India

In India, the roots of technology are growing into the banking sector as well and are empowering banks to adopt a location-agnostic banking approach to provide services to everyone. This wave of technology seen sweeping the 21st century has led various banks to provide branchless banking facilities to a wider spectrum of audiences. If the banking scenario of other countries in the world is to be considered, the need for a digital change in this domain was driven by comfort, but in India, this change has been driven by the economic obligation to ensure financial inclusion.

So is the future of banking branchless?

Yes, branchless banking in india is the future!

Going branchless would benefit everyone in numerous ways, some of them are given below-

Business perspective

- The Cost of operations and management gets reduced.

- Customer demands are met with an enhanced customer experience.

- Additional resources get invested in launching new products and in expansion to different geographies. This also helps facilitate doorstep delivery of essential banking services to rural India.

Customer perspective

- Financial transactions become easy and convenient to perform from any location at any given time.

- With a greater reach and equal opportunities for all the people, everyone gets to avail all the banking facilities.

- Standing in queues with a token in hand is a thing of the past and now services are available at the click of a button.

Proceed with a plan: A period of customer-first banking services lies ahead

With Artificial Intelligence growing significantly, AI-based solutions like virtual avatars and AI chatbots are being used as tools on various online banking platforms to facilitate growth in the financial sector and improve customer satisfaction. It has been estimated that AI will contribute to about $1.1 trillion in the next 10 to 15 years to the domain of finance. The large investments being done towards branchless banking will favour customer requirements and ensure a digitally centered country when it comes to the financial domain. The democratization of AI in banking will give rise to an improved customer experience, making way for secure financial transactions on desired channels and an essential modern business mindset of a digital-first banking experience. An existing tug of war between several financial institutions when it comes to customer engagement has made it imperative to proceed with a strategy in mind.

Some quick tips to keep in mind while doing so are:

-Make extensive use of AI.

-Implement data-driven enterprising management.

-Arrange for consistent and hassle-free services.

-Segregate all the processes in different departments for better efficiency.

These pointers will make sure you succeed while developing the most proficient scheme to join hands with the banking industry’s new mantra of branchless banking.

Want to take a look at what else you can do in the field of industry penchant branchless banking? Book a demo with us today to take a look into the diverse solutions available comprising of all the features required to develop a Digi face of the bank.